Can the swarm of young U.S. investors (keyword: Wallstreetbets) attack the silver market, cause the silver price to explode and endanger the entire banking industry? On Monday morning, silver already moved up significantly. An analysis.

Attack of the gambler swarm

Terms like GameStop, Reddit and Wallstreetbets have been at the top of search trends in Germany for a few days now. At Google, queries for these keywords have skyrocketed (see chart below). And the story has not passed the mainstream media by either. After all, it all sounds fantastic.

The story about a huge community of young investors forming a concentrated attack against hedge funds on message boards (e.g. Reddit). They simply buy shares that are sold short by the capital giants. In doing so, they bring the funds to the brink of ruin and make a lot of money in the short term.

However, collectively they threaten the entire capital market. In our article from Saturday, we have already outlined the background: „Are Wallstreetbets killing Wall Street?“

Silversqueeze?

On Twitter, the term „silversqueeze“ „trended“ over the weekend. That’s because there’s speculation that the Reddit community might rush into the silver market to push the price of the precious metal higher. How realistic is the assumption that short-sellers can be pushed out of their positions and the silver price manipulated upward? On Monday morning, the price of silver already moved up 8 percent. However, speculation about possible manipulation attempts alone may push the silver price higher.

Silver Manipulation

How susceptible is the silver market to manipulation in general? We have been reporting systematic intervention in the opposite direction for years. Silver manipulation by big banks is not a conspiracy theory. It is fact.

Big banks on the silver market

What is the current situation on the silver market? How are the big banks positioned? Let’s take a look at the „Bank Particpation Report“ from the beginning of January. Once a month, the U.S. Securities and Exchange Commission (CFTC) publishes the positions of U.S. and non-U.S. banks in futures trading on the COMEX commodity futures exchange.

U.S. banks short 5,678 tons of silver

As of Jan. 5, 2021, four U.S. banks (unnamed) held a net short position on silver totaling 36,515 contracts. A standard contract consists of 5,000 ounces of silver. Thus, the aforementioned forward sales represent 5,678 tons of silver. This was the highest value since September 2019.

The chart shows the current situation. The net short position of U.S. banks at that time represented 22.6 percent of the total open interest – that is, the corresponding share of all running silver contracts on the COMEX.

This net position consisted of only 3,774 long positions, but 40,289 short positions. So, in total (gross), this U.S. banking group held forward sales on silver equivalent to 6,264 tons.

Foreign banks

The 21 reported non-U.S. banks came to a net short position of 27,008 contracts as of the same date. That is, the equivalent of 4,199 tons of silver.

Thus, all banks combined were sitting on a net short position equivalent to forward sales of 10,463 tonnes. By comparison, the Silver Institute reported world annual production from mines of 31,821 tons for 2019.

Paper silver worth $24.2 billion

So what market value are we talking about with a current silver price of $27.06 per ounce (Friday’s closing price of U.S. futures)?

The open interest, i.e. the sum of all open silver contracts on the COMEX, was 178,898 contracts on Friday. Thus, silver totaling 894,490,000 ounces was traded (27,818 tons). These possessed a market value of 24.2 billion US dollars. In this context, the net short position of the US banks corresponded to a market value of US$5.47 billion.

10x leverage

The fact is, however, that the capital employed by futures traders is essentially limited to the margins (security deposits). Currently, silver futures traders must deposit $14,000 per contract if they hold the contract for more than one day. A standard contract (5,000 ounces) recently traded $135,300 worth of silver. This means that in trading silver futures, there is currently a leverage on the silver price of 9.66.

Silver cover on the COMEX

However, only part of the silver traded in futures is physically available on the COMEX. Silver inventories totaling 397,322,796.47 ounces were reported in the exchange’s silver warehouses as of January 28, 2021. This is equivalent to 12,356 metric tons. With a current open interest of 178,898, COMEX players traded a total of 894.49 million ounces in the form of silver futures. Thus, only 44 percent of the trade was physically covered.

Note: JP Morgan Chase & Co.’s COMEX inventory alone comprised 193.9 million ounces of silver last Friday. However, 152.0 million ounces (79%) did not belong to the bank itself. Rather, this silver was held in custody on behalf of customers (category: „eligible“).

Wallstreetbets

If the „Wallstreetbets“ want to conquer the silver market, they will not invest in futures. More obvious are exchange-traded ETFs that you can easily trade through the low-cost brokers. One of these, for example, is the iShares Silver Trust. When investing massively there, the fund operator is forced to buy silver on the market. Each share of this fund must be covered with an ounce of silver. And this has a price-driving effect in any case.

Futures market

What happens now, if the silver price rises strongly? First of all, margins will be increased on the COMEX. A 50 percent margin increase already costs the banks a total of around 2.7 billion US dollars in additional collateral. That should not be a problem for the time being. But if, for example, the banks have sold a February contract at 27 U.S. dollars and the price of silver rises sharply by the expiration date, then things will get really expensive again.

Billions in losses?

Hypothetical calculation:

- All banks sell via futures 10,463 tons of silver (336.4 million ounces) at US$27 per ounce for February delivery. Value of this silver = $9 billion. This is the amount the banks receive for the silver sold.

- The price of silver rises by 50 percent to 40.5 U.S. dollars by then.

- The banks would then theoretically have to buy silver worth 13.6 billion U.S. dollars or raise the corresponding cash to service their contracts, for which they receive only 9.08 billion U.S. dollars. Loss: US$4.71 billion.

- If the price of silver doubled to $54, the loss to the banking industry would rise to $9 billion.

- If the price were to increase tenfold to 270 US dollars, the loss to the banking industry would be 47 billion US dollars.

Note: This is only the futures market. Silver is of course also traded (and shorted) via other derivatives such as options and swaps.

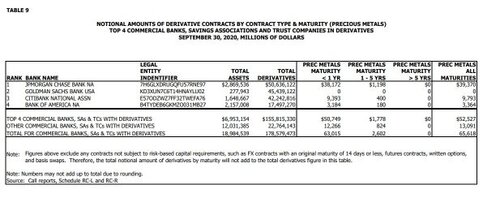

According to the most recent OCC (The Office of the Comptroller of the Currency) regulatory report, $65.6 billion in notional volume of precious metals derivatives were traded by U.S. banks in the third quarter of 2019. That was a new record high. And note: banking giant JP Morgan Chase & Co alone accounted for $39.37 billion of that total. That corresponds to a market share of 60 percent.

.

Silver price effect

This means that if the silver price rises sharply, banks are likely to try to get rid of their short positions as quickly as possible. However, to do this, you need to find sellers. Because to close out a short position, you have to buy a long contract. And with that, the COMEX could very quickly reach its limits.

Especially because it is precisely the banks, as market makers, that take the counter position when no other trader is available. After all, that is also the reason why the institutions have such high short positions in bull markets. Thus, an attack on the banks generally threatens the functioning of the relevant marketplace.

And that is why the exchange operators will try with all their might to prevent a fast and strongly rising price in futures trading. To this end, there are already mechanisms in place that provide for the suspension of trading if the price exceeds certain rise thresholds within the day. If this happens several times, trading can be suspended for the entire day. It would even be conceivable that COMEX would remain closed for several days in such an extreme situation in order to wait until the market calms down.

Market comparison

What are the chances of success for a swarm attack on the silver price? Let’s compare theory with practice. Wallstreetbets managed to drive up GameStop’s stock price from $19 to $325 since Jan. 12, 2021 (as of 01/29-21). With 69.75 million GameStop shares outstanding, their market capitalization increased from $1.3 billion to $22.67 billion.

Selected Silver/Precious Metals Markets (Market Size/Capitalization):

- U.S. precious metals derivatives: $65.6 billion

- Silver futures COMEX: $ 24.2 billion

- Silver ETF-SLV: $ 16.49 billion

So the individual markets are quite comparable in size.

All the silver in the world

Another comparison: According to the U.S. Geological Survey, mankind has so far extracted 1.74 million tons of silver from the earth. This corresponds to a cube with a side length of 55 meters. At an ounce price of $27 per ounce ($867.75 per kilo), all the silver in the world is worth $1.5 trillion. However, large portions of this metal are simply not available. More than half of it has been „consumed“ by industry alone.

Conclusions

Can Wallstreetbets and co. attack the silver market? Yes, they could make short-sellers in individual silver markets sweat profusely. This becomes clear by comparing the respective market capitalization. However, representatives of the trading venues and regulators will pull out all the stops to keep damage away from the banks.

And with JP Morgan Chase & Co., a systemically important giant is at the center of such a silver market attack. It could be a dangerous fight. Even with serious consequences for the entire financial industry.

And for all the fascination with a spectacular showdown between „David and Goliath“: Consider the dramatic consequences of a possible new financial crisis when asking others to join the game on the side of the swarm!

Note: We have presented all information and calculation examples to the best of our knowledge. However, we do not assume any liability for the figures!

Translated with www.DeepL.com/Translator